You have felt it!! Gas, Groceries, Cars, Tools, and EveryDay Items are going up and cost more

almost daily. These climbing consumer costs hurt your Budget, possibly postponing many

purchases, especially the larger items.

Here are thoughts on why Buying a Home or Owning a Home can help you fight the demands of

inflation.

Owning a Home or Buying a Home will help you maintain Your Largest

Monthly Expense

Investopedia explains that during a period of high inflation, prices rise across the board. That’s

true for things like food, entertainment, and other goods and services, even housing. Both rental

prices and home prices are on the rise. So, as a buyer, how can you protect yourself from

increasing costs? The answer lies in homeownership.

When you buy or have a home, you have a fixed-rate mortgage on your home, your monthly

payment is fixed for the duration of your loan, often 15 to 30 years. James Royal, Senior Wealth

Management Reporter at Bankrate, says:

“A fixed-rate mortgage allows you to maintain the biggest portion of

housing expenses at the same payment. Sure, property taxes will rise

and other expenses may creep up, but your monthly housing payment

remains the same. That’s certainly not the case if you’re renting.”

So even if other prices increase, including the value of your home, your housing payment will

remain steady. Renters will not have that same benefit and will not be protected from rising

rental rates.

Investing in an Asset That Historically Outperforms Inflation

While it’s true rising home prices and higher mortgage rates mean that buying a house today

costs more than it did even a few months ago, you still have an opportunity to set yourself up for a long-term win. That’s because, in inflationary times, you want to be invested in an asset that

outperforms inflation and typically holds or grows in value.

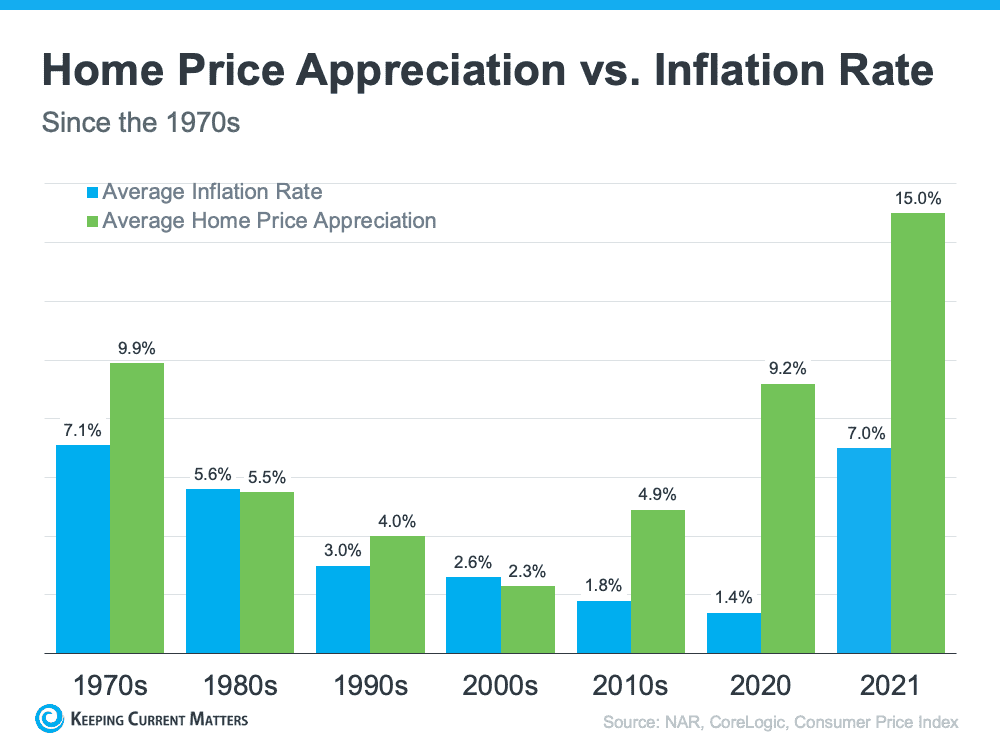

The graph below shows how the average home price appreciation outperformed the average

inflation rate in most decades going all the way back to the seventies – making homeownership

a historically strong hedge against inflation (see graph below):

So, what does that mean for you? Today, experts forecast home prices will only go up from here

thanks to the ongoing imbalance of supply and demand. Once you buy a house, any home price

appreciation that does occur will grow your equity and your net worth. And since homes are

typically assets that grow in value, you have peace of mind that history shows your investment

is a strong one.

That means, if you’re ready and able, it makes sense to buy today before prices increase

more.

Final Thought

If you’ve been thinking about buying a home this year, it makes sense to act soon, even with

inflation rising. That way you can fix your monthly housing cost and invest in an asset that

historically outperforms inflation.